The joy spherical biodiversity credit score was evident at Bloom 24 and UN COP16 in Colombia. Rooms crammed and queues common for events after they topped the agenda.

Biodiversity credit score are gaining consideration, nonetheless for lots of sustainability leaders they proceed to be a thriller. How do they work? Are companies searching for them? And, if that is the case, why? I spoke with problem builders, necessities our our bodies and enterprise consultants to hunt out options.

An rising market

Biodiversity offsets are well-established in nationwide and worldwide environmental governance. The Convention on Natural Vary launched draft concepts in 2009 for biodiversity offsets and Germany has had biodiversity offsetting regulation since 1976. Nevertheless voluntary biodiversity credit score — the sort a CSO could bear in mind as part of their agency’s nature method — are nonetheless rising, as an concept and as a market.

“Nobody’s constructive whether or not or not there are adequate corporates in the marketplace ready to fund conservation or restoration by the acquisition of credit score,” talked about Jo Anderson, CEO of Stage, which helps native conservation initiatives uncover funding and is exploring biodiversity credit score as a choice to fund its work.

Nonetheless, the voluntary space is growing. Consistent with Simas Gradeckas, creator of Bloom Labs, a biodiversity finance e-newsletter, 53 biodiversity crediting initiatives are each already energetic or under enchancment, and some established carbon credit score rating necessities our our bodies are creating alternate choices for biodiversity initiatives.

“We used concepts from the carbon markets, akin to top quality, additionality and no double-counting, for our biodiversity customary,” talked about Alex Saer, CEO of Cercarbono, a certification program based totally in Colombia.

As necessities operationalize, problem builders will search unbiased verification for his or her biodiversity conservation and restoration work. Necessities our our bodies will solely topic credit score to a problem if it fulfils certain top quality requirements. This consider course of will likely be extended.

However credit score are anticipated shortly. Savimbo, a problem conserving jaguars in Colombia, has simply these days been verified by Cercarbono. and Plan Vivo, a carbon and nature customary, is reviewing about 10 biodiversity initiatives and expects to topic credit score subsequent 12 months.

What are biodiversity credit score?

The Biodiversity Credit score rating Alliance, a bunch working to establish a biodiversity credit score rating market, makes use of this definition: “A certificates that represents a measured and evidence-based unit of optimistic biodiversity closing outcome that is sturdy and further to what would have in another case occurred.”

Specialists I spoke to produce totally different descriptions: an “totally different methodology for measuring the price of ecosystems,” a “unitized biodiversity purchase or averted loss” and a “share change per hectare” of species abundance.

“A typical biodiversity credit score rating could characterize a one-percent improve in biodiversity metrics over one 12 months, for one hectare of land,” talked about Gradeckas.

Credit score rating: Simas Gradeckas

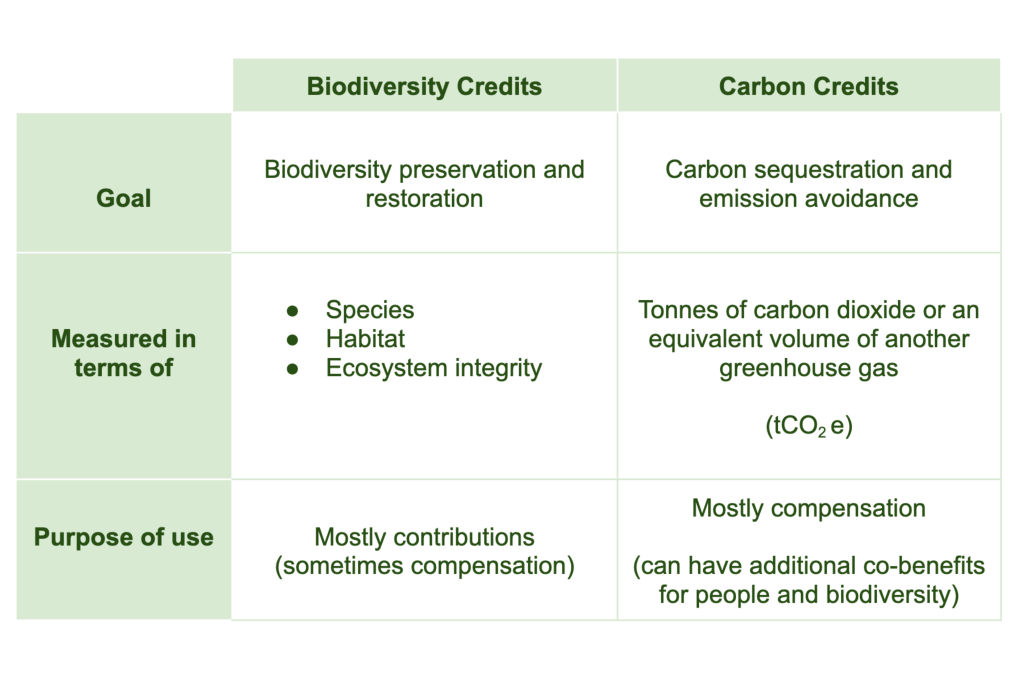

How they differ from carbon credit score

The time interval “biodiversity credit score rating” is a bit misleading. Its similarity to “carbon credit score” implies that biodiversity credit score are merely the an identical concept repackaged for vegetation and animals. This is not the case; nature should not be carbon and must be valued in one other manner.

Carbon credit score are interchangeable, with each theoretically representing one metric ton of carbon that has been away from, or prevented from coming into, the surroundings. This uniformity permits companies to say to compensate for one tonne of emissions launched in, say, the U.S. by searching for a carbon credit score rating representing one tonne of emissions sequestered elsewhere — in Kenya, for example.

Biodiversity credit score mustn’t so interchangeable. If a company destroys 5 hectares of habitat inside the U.S., it could possibly’t compensate by paying for the conservation of 5 hectares in Kenya, on account of the geology, soils and vegetation are distinctive to each location.

Why spend money on this?

Given the geographic specificity of biodiversity credit score, it’ll seemingly be unusual that a company can use them to straight compensate for his or her environmental hurt. The market is because of this reality relying on totally different enterprise use cases — and these will probably evolve.

Correct now, regulation, self-preservation and have an effect on are a very powerful causes a company would buy biodiversity credit score.

Companies could voluntarily help biodiversity initiatives in anticipation of the time when doing so turns into compulsory. Definitely, with the EU’s CSRD regulation and the rising prominence of the Taskforce on Nature-Related Financial Disclosure’s steering, companies are already going by means of stress to report and mitigate their biodiversity impacts.

And as companies search to eliminate vulnerabilities from their present chains, they might buy biodiversity credit score from initiatives that protect and restore the exact ecosystems upon which their operations rely.

“If companies wait to find out their full [nature] impacts spherical present chains or price chains, then they’re inserting themselves in peril in that prepared interval,” talked about Toral Shah, biodiversity coordinator at Plan Vivo, the carbon and biodiversity standard-setting group.

“One among many large causes to engage now’s positively to develop the biodiversity credit score rating market. That is going to finish in a higher space that is designed to meet firm desires,” talked about Keith Bohannon, CEO of Plan Vivo.

What can a company declare?

Although optimistic publicity would possibly current one different incentive to buy biodiversity credit score, companies are rightfully cautious of greenwashing and associated reputational hurt. Notably given the nascency of the market, sustainability teams would possibly wish to conduct intensive due diligence sooner than shopping for biodiversity credit score and understand what environmental claims can and will’t be made.

The sorts of nature claims a company can promote depend on which customary issued the biodiversity credit score it has purchased. In the mean time, companies might make each a “contributory declare” (we’ve funded a problem that has protected 1,000 hectares of jaguar habitat in Colombia) or a “compensation declare” (we destroyed 1,000 hectares of habitat and have tried to make amends by restoring 1,000 hectares of a comparable ecosystem).

“In our protocol, we’re pretty clear that these credit score cannot be used for compensating … what you’ll be able to do is declare you is likely to be funding and making efforts to revive or to protect certain areas,” talked about Saer.

To take care of up with developments inside the biodiversity credit score rating market, adjust to the Worldwide Advisory Panel for Biodiversity Credit score, the Biodiversity Credit score rating Alliance and the World Monetary Dialogue board’s Biodiversity Credit score rating Initiative.

[Get the latest insights on nature, carbon markets, disclosure, and more at GreenBiz 25 — our premier sustainability event, Feb. 10-12, Phoenix.]